UMC Fund Balance Report 2016-2026 free printable template

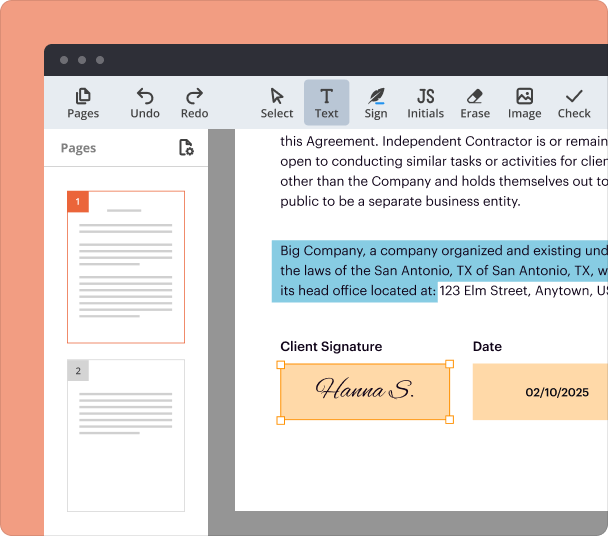

Fill out, sign, and share forms from a single PDF platform

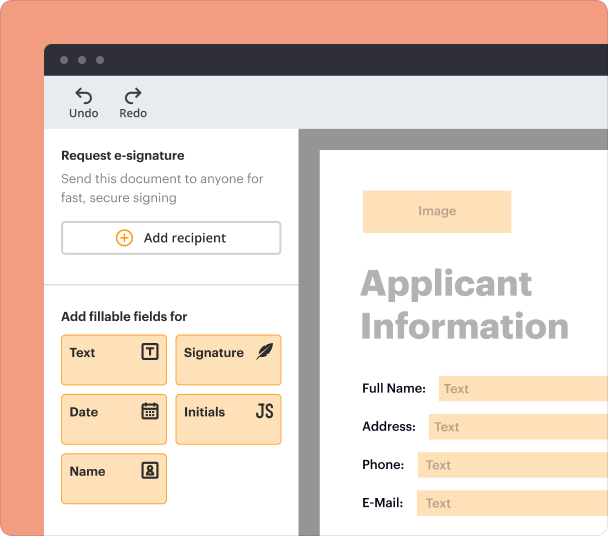

Edit and sign in one place

Create professional forms

Simplify data collection

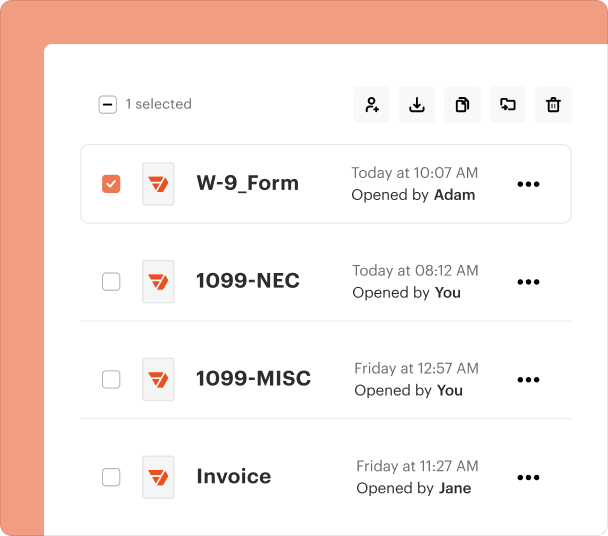

Manage forms centrally

Why pdfFiller is the best tool for your documents and forms

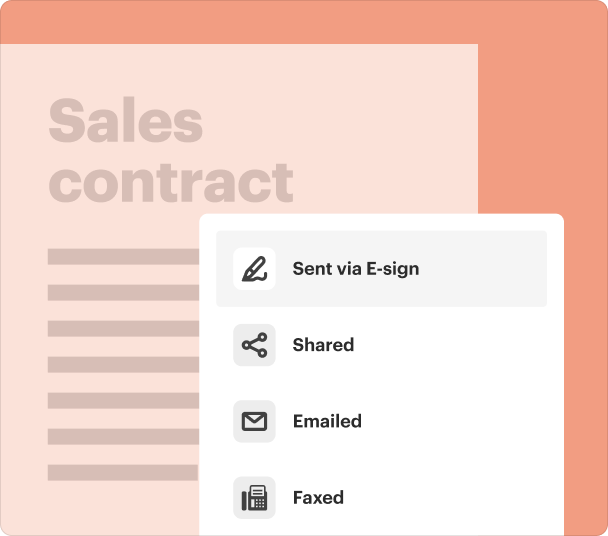

End-to-end document management

Accessible from anywhere

Secure and compliant

UMC Fund Balance Report Form Guide

This guide provides detailed insights into the UMC Fund Balance Report Form, outlining step-by-step instructions for completion, best practices for audits, and resources for effective financial management in churches.

What is the UMC Fund Balance Report?

The UMC Fund Balance Report serves as a crucial tool for tracking the financial health of the church, enabling transparency and accountability in financial dealings. It outlines the receipts, disbursements, and balances of church funds, which are vital for maintaining trust among stakeholders.

-

To provide a comprehensive overview of the financial transactions and balances of the church, aiding in effective fund management.

-

Key stakeholders involved include financial officers, members of the committee on finance, pastors, and district superintendents.

What are the key sections of the Fund Balance Report?

The Fund Balance Report contains several critical sections, including Receipts, Disbursements, and Balances. Each of these sections demands precise and thorough reporting to ensure accurate financial representation of each church fund.

-

This section records all income sources, such as donations and fundraisers.

-

It outlines all expenditures, including operational costs, outreach programs, and salaries.

-

This reflects the remaining funds after accounting for receipts and disbursements, which is crucial for financial planning.

How do you complete the Fund Balance Report?

Completing the UMC Fund Balance Report involves following a step-by-step process to fill out each section correctly. Adhering to the established timelines ensures your document is submitted promptly.

-

Collect all necessary financial records, including previous reports and current ledgers to ensure accuracy.

-

Carefully enter data into Receipts, Disbursements, and Balances, being mindful of accuracy in all figures.

-

Check for common errors, such as miscalculations or missing signatures before submission.

-

Adhere to the submission deadlines to ensure compliance with UMC policies.

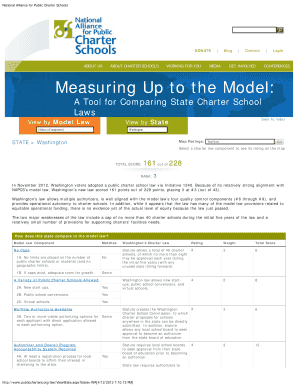

What are audit guidelines and best practices?

The auditing committee plays a pivotal role in verifying the accuracy of the Fund Balance Report. Compliance with UMC guidelines during the audit process safeguards against discrepancies.

-

The committee is responsible for reviewing financial records and ensuring adherence to accountability standards.

-

Regular monitoring, standardized reporting formats, and thorough training for financial officers help maintain compliance.

-

Misreporting of income or expenditure figures can lead to significant audit issues; thus, it is vital to double-check all information.

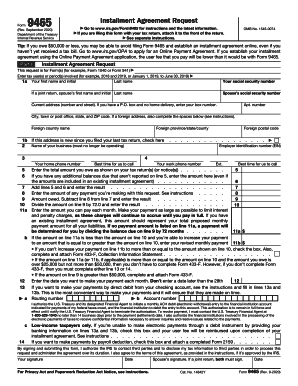

How can pdfFiller help in managing the Fund Balance Report?

pdfFiller simplifies the process of handling the UMC Fund Balance Report by providing tools for editing, eSigning, and cloud-based document management. Users benefit from collaborative features that enhance efficiency and ensure smooth financial reporting.

-

Use pdfFiller to seamlessly edit your report, adding or modifying information as necessary.

-

Easily gather required signatures from stakeholders online, accelerating the submission process.

-

Share documents with team members for real-time feedback and revisions.

-

Access your documents from anywhere, ensuring that your financial reports are always up-to-date.

What are the filing and record-keeping guidelines?

Proper filing and record keeping are essential for maintaining transparency and accountability in church finances. Knowing where and how to file the completed report is equally important.

-

Ensure that the completed Fund Balance Report is filed in designated UMC offices or repositories as required.

-

It's critical to maintain accurate, organized records for reference during audits and reviews.

-

Provide copies of the report to relevant authorities, such as the committee on finance and supervising district superintendent.

What resources are available for further reading?

To enhance your understanding of the Fund Balance Report process, numerous resources are available for further reading. These resources can deepen your insights into UMC financial guidelines and additional documentation for the Charge Conference.

-

Links to official UMC financial resources that provide comprehensive guidelines on managing church finances.

-

Additional documentation required for effective management during the Charge Conference, ensuring compliance and organization.

-

Suggested readings that offer insight on best practices in church finances and the UMC's financial accountability.

Frequently Asked Questions about umc fund report form

What is a Fund Balance Report?

A Fund Balance Report is a financial document that details the receipts, disbursements, and balances of various church funds. It serves as a tool for transparency and accountability, ensuring stakeholders are informed about the church’s financial standing.

Why is accuracy important in the Fund Balance Report?

Accuracy in the Fund Balance Report is critical as it affects the church’s financial integrity. Inaccuracies can lead to audits, financial mismanagement, and a loss of trust among stakeholders.

How can I avoid common errors when completing the report?

To avoid common errors while completing the report, always double-check your figures, ensure all signatures are obtained, and validate that all necessary documentation is included. Familiarizing yourself with the required format can also help reduce mistakes.

What should I do if I find errors after submission?

If you discover errors after submission, it’s vital to address them promptly by contacting the appropriate authorities within your church. Amendments should be made to reflect accurate financial information as soon as possible.

Is pdfFiller secure for managing financial documents?

Yes, pdfFiller provides a secure platform for managing financial documents. With features like encrypted storage, user permissions, and eSigning, it ensures your sensitive financial information is protected while being easily accessible to authorized personnel.

pdfFiller scores top ratings on review platforms